whitehat

Well-Known Member

Lại một anh tài nữa, Boris Marjanovic - Hedge fund manager, bay ra sọc Tesla (TSLA) với lý do công ty này đã áp dụng những thủ thuật tài chính (Financial Shenanigans), nhằm che mắt đám đông thiếu hiểu biết (TSLA niêm yết ở NASDAQ, không bị ràng buộc theo chuẩn GAAP ?) :

- From non-GAAP revenue to non-GAAP net income, the company has come up with a variety of "adjusted" performance numbers to mislead and confuse the ignorant investment herd into buying its grossly overvalued stock.

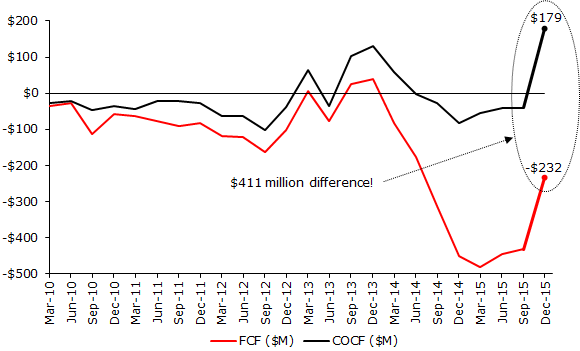

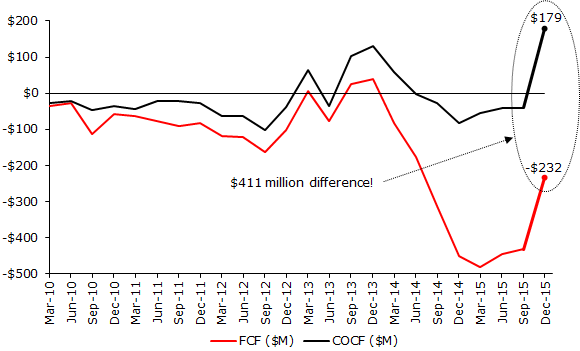

- Tesla introduced a new metric called "core operational cash flow", or COCF for short... COCF isn't the cash flow metric we're used to seeing. Such free cash flow (or FCF) is traditionally computed as operating cash flow minus CapEx. The measure Tesla invented is defined as operating cash flow plus cash from collateralized borrowings.

Note: COCF is equal to the sum of operating cash flow and cash from collateralized borrowings. The FCF metric presented here is defined as COCF minus CapEx.

- From non-GAAP revenue to non-GAAP net income, the company has come up with a variety of "adjusted" performance numbers to mislead and confuse the ignorant investment herd into buying its grossly overvalued stock.

- Tesla introduced a new metric called "core operational cash flow", or COCF for short... COCF isn't the cash flow metric we're used to seeing. Such free cash flow (or FCF) is traditionally computed as operating cash flow minus CapEx. The measure Tesla invented is defined as operating cash flow plus cash from collateralized borrowings.

Note: COCF is equal to the sum of operating cash flow and cash from collateralized borrowings. The FCF metric presented here is defined as COCF minus CapEx.